A report published by the Office for Budget Responsibility (OBR) shows that the risks to the fiscal outlook from climate impacts are mounting.

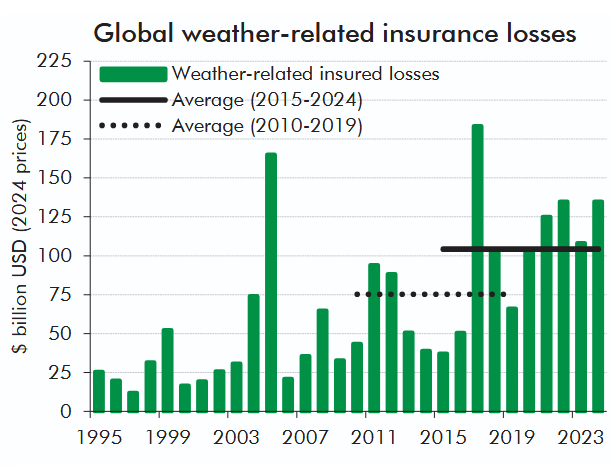

The report notes the impact of climate change and adds that the costs of a hotter and more volatile climate are also rising, with the latest estimated 10-year average economic and insured losses from extreme weather up by 29 and 38 per cent, respectively, on the previous rolling 10-year average.

Climate change, it notes, creates risks to the public finances through three main channels: mitigation: the fiscal costs incurred to transition from a fossil fuel-based to a net zero emissions economy; damage: the costs to government from the damage to the economy and public finances caused by a hotter climate with more extreme weather; and adaption: the costs to government of measures taken to reduce the impact on, and increase the resilience of, the economy to higher temperatures and increasingly volatile and extreme weather.

The OBR latest estimate is that the fiscal costs from climate-related damage could add 2.0 per cent of GDP to primary borrowing by the early 2070s, 0.7 percentage points higher than its previous estimate. This is based on a scenario where global temperatures rise to just below 3C above pre-industrial levels.

The bulk of the fiscal costs from this increased damage are due to lower productivity and employment and therefore lower tax receipts. The accumulated impacted of higher primary borrowing and the additional debt interest costs could add 56 per cent of GDP to debt by the early 2070s.

The latest central estimate of the fiscal cost of climate change mitigation through to 2050-51 is £30bn a year on average, of which two-thirds can be attributed to lost receipts. Expenditure accounts for the bulk of the fiscal cost in the next decade, particularly public investment in residential buildings, removals and surface transport. Receipts losses – mainly from lost fuel duty receipts – rise steadily over the projection period.

The impact of the net-zero transition on the public finances is, in the OBR central scenario, because the government bears around 36 per cent of the CCC’s latest estimate of the whole-economy costs, which would amount to around £9.9bn (0.3 per cent of GDP) per year between 2025 and 2050. The net-zero investment spending for the next four years announced by the Government in the 2025 Spending Review is broadly in line with this assumption.

The government needs to replace the revenue losses from declining consumption of hydrocarbons, with predicted revenue losses amounting to £20.5bn (0.5 per cent of GDP) per year on average between 2024-25 and 2050-51. Of this, three-quarters comes from declining fuel taxes as petrol-driven cars are replaced by electric vehicles.

However, the costs to government of the net-zero transition, of 21 per cent of GDP, is 9 per cent of GDP lower than the previous estimates in the 2021 Fiscal Risks report. This reduction is mainly driven by the CCC’s latest estimates of the whole-economy investment cost of reaching net-zero. This reduction in climate mitigation costs stands in contrast to the rising costs of climate damage since our previous assessment, which unlike transition costs are driven by the degree to which the major global emitters reduce their emissions over the coming decades, rather than what happens in the UK.

© 2019 Perspective Publishing Privacy & Cookies

Recent Stories